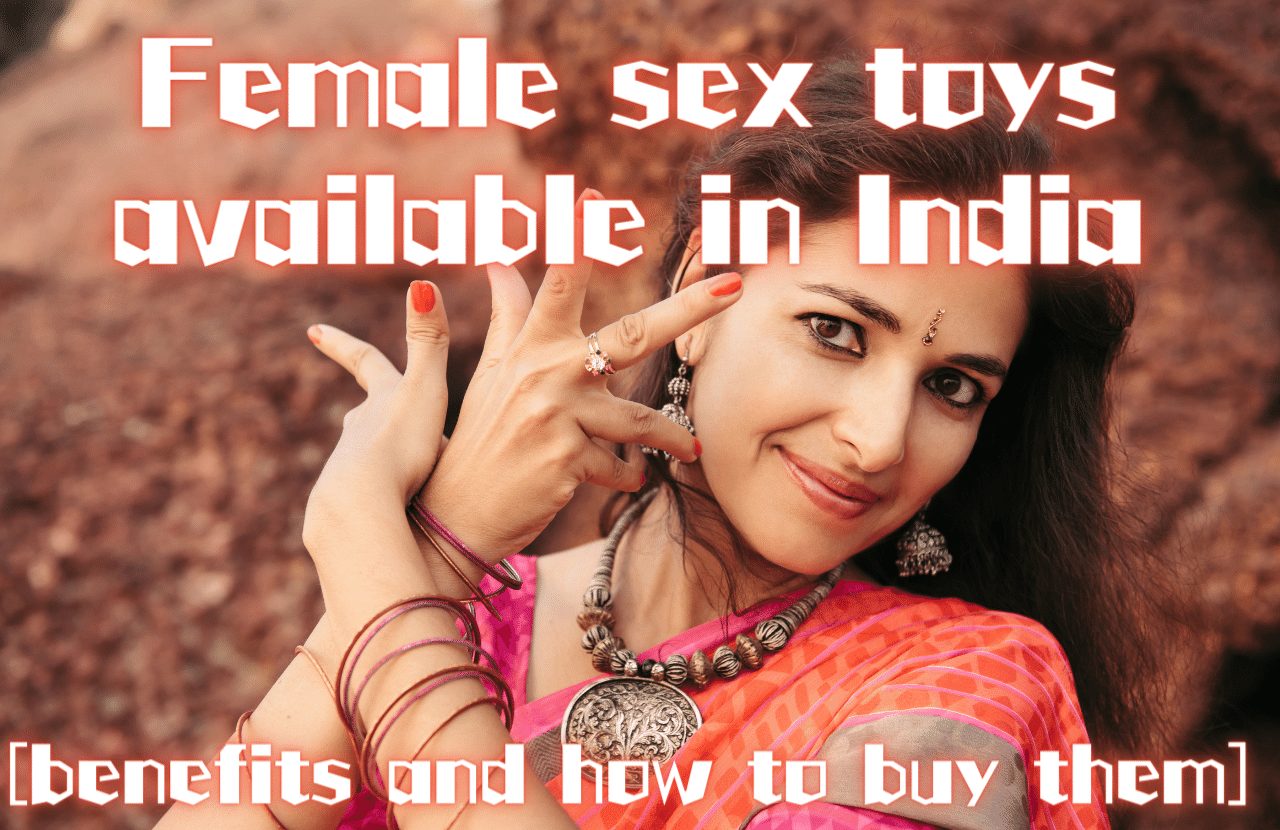

There are three main types of female sex toys available in India: dildos, vibrators, and strap-ons.

In addition, condoms and lubricants are also great female sex toys.

In this article, I’ll show you what types of sex toys are available, how to use sex toys for sex and masturbation to make you feel more comfortable, and how to buy sex toys for women in India while protecting your privacy.

- You want to buy a sex toy from a reputable store.

- You are interested in sex toys for women.

- You want to develop an orgasm.

- You want to check out a lot of sex toys for women.

- You want to know how to use sex toys specifically.

All of these questions can be answered in this article. Please stay with us until the end.

Types of sex toys for women available in India

Now let’s check out the different types of female sex toys available in India!

If you tap the “GO” button in the table, you can jump right to the toy you want.

Tap “GO” in the table to jump to the toy you want.

| Dildo | Vibrator | Strapon | |

| Sexual sensitivities | Portio(cervix) | Critoral G-spot | Portio(cervix) |

| Price range | Rs1450~ | Rs500~ | Rs3482~ |

| Check | Go | Go | Go |

Basically, you can use dildos for inside orgasm, vibrators for outside orgasm, and straps on for inserting yourself into a partner (male or female).

Let’s take a closer look at each of these sex toys in the next section!

“I want to see the sex toy rankings right now!”

If you want to see the sex toy rankings right now, please check out the following article that lists the top 25 sex toys for women.

So let’s get right to it!

Dildo

A dildos is a cruciform that resembles a male organ, and is a toy for women to use for masturbation and sex.

A dildo is a toy used by women for masturbation and sex.

Among them, a dildo made to resemble male genitalia is called a realistic dildo, while a dildo made to look less like male genitalia is called a non-realistic dildo.

There are also double-headed dildos with the insertion part on both ends.

These dildos can be inserted from both ends, so they are mainly used by lesbians for sex or by people who want to use a larger dildo.

Both dildos can be inserted into the vagina to feel orgasms or to develop the so-called inside orgasm zones such as the portio and G-spot in the vagina.

What is an inside orgasm? If you have any questions, please click here to read the article.

In addition to appearance, there are various classifications based on material and purpose of use, but let’s start with a simple explanation of the above three categories: realistic dildos, non-realistic dildos, and double-headed dildos.

Realistic Dildo

Realistic dildos, as the name suggests, are dildos that are made to replicate a realistic penis.

Many dildos are made in the shape of actual penises, including the texture, veins, and glans, so they feel as good as the real thing.

Many of them are also made with a particular coloring, and many of them are made with a blood color.

The veins when the penis is erect are very well made, and you can enjoy a more realistic feel.

If you like portio, G-spot and other vaginal orgasms, or if you want to develop your vagina, dildos are for you.

| XXX Indian Dick Man 5 | XXX Indian Dick Man 6 *Best Seller* | Shiny straight dick Dark Brown | Realistic dildo 5in | Real Flesh Dildo skin | New clear desi dildo pink | New clear desi dildo clear | Real Flesh Dildo black |

|  |  |  |  |  |  |  |

| Rs1450 (Best Value) | Rs1650 | Rs2000 | Rs2125 | Rs3000 | Rs3000 | Rs3000 | Rs3000 |

| Dia1.6×5in | Dia1.6×5.3in | Dia1.1×7in | Dia1.18×5in | Dia1.5×6.7in | Dia1.5×6.2in | Dia1.5×6.2in | Dia1.3×6.6in |

| 150g | 175g | 156g | 95g | 220g | 205g | 205g | 226g |

| BUY | BUY | BUY | BUY | BUY | BUY | BUY | BUY |

Non-Realistic Dildo

In contrast to the realistic looking realist dildos, the non-realistic dildos are much more realistic.

If you want to develop your vagina, such as portio and G-spot, but have a hard time buying a realistic looking dildo, I recommend the non-realistic dildo.

Incidentally, this is the type that the administrator uses.

I live with my partner, so it’s hard for me to use something that is realistic.

This is the type that I use, by the way. It’s hard for me to use something realistic because I live with my partner

I’ve known for a while that Priya has a dildo, but I’m pretending not to know. I don’t think she’d want me to imagine her using it…

…

| CHOCOLATE LILY | White Big dick M size | White Big dick Lsize | GLASS WONDER No. 9 |

|  |  | |

| Rs3883 | Rs2099 (Best value) | Rs2295 | Rs3239 |

| Dia1.45×5.3in | Dia1.41×6.1in | Dia1.96×5.9in | Dia1.3×6.5in |

| 205g | 281g | 281g | 281g |

| Silicone rubber | Elastomer | High-quality elastomer | High-quality glass |

| BUY | BUY | BUY | BUY |

Double-headed Dildos

As the name suggests, a double-headed dildo is a type of dildo that has a glans on both ends.

It was designed to be used by lesbian couples to insert themselves into each other, but it is actually quite easy to use for masturbation as well.

When you want to use it as a short dildo, you can insert it shallowly, and on the other hand, when you want to use it as a long dildo, you can insert it deeply, so if you have one, you can increase the variation of its usage considerably.

Also, most of the double-headed dildos are quite flexible, so you can bend them and insert them into both the vagina and the anus.

This play is quite advanced, but…

The appeal of the double-headed dildo is that it can be enjoyed by a wide range of people, from beginners to advanced players, and even lesbians.

| Pink Double Dong | SOUTOU KAKKA HONEY SHORT *Best Seller* | SOUTOU KAKKA WILD LONG | MAGNUM Z 26 | MAGNUM Z 25 | Double side crystal dildo |

|  |  |  |  | |

| Rs3250 (Best Value) | Rs3464 | Rs4406 | Rs4984 | Rs4984 | Rs4999 |

| Dia0.4~1.3×6.7in | Dia0.82~1.41×10.62in | Dia1.18~1.65×14.56in | Dia?×12in | Dia?×12in | Dia7 x 1in |

| 275g | 169g | 342g | ?g | ?g | 183g |

| Silicone | High-quality soft rubber | High-quality soft rubber | Safe Rubber | ? | Silicone |

| BUY | BUY | BUY | BUY | BUY | BUY |

Vibrators

Vibrators are toys that have a rotor built into the plastic or silicon exterior, and the vibrations from the rotor’s rotation stimulate your sex zones.

They can be purchased at a relatively low price point, making them perfect for sex toy beginners to purchase for the first time!

They range from inexpensive to expensive types, but the inexpensive types of Vibrators under Rs2000 are usually not completely waterproof. (Although some of them are made to be inserted.)

Therefore, they are basically used to stimulate the clitoris or nipples from the outside without inserting them into the vagina.

Because they can be used without inserting them, they are classified as beginners’ sex toys for women, and are easy to introduce even to those who are not comfortable with sex toys.

There are four main types of Vibrators available in India.

- Egg Vibrators

- Dildo Vibrators

- Remote Control Vibrators

- Vibrators for nipples

Let’s take a look at each of these Vibrators in detail!

Egg Vibrators

Egg Vibrators are one of the most popular and orthodox types of Vibrators.

↑Egg Vibrators, as the name suggests, are characterized by the rounded egg-shaped vibrating parts.

They do not require any special parts, so they are inexpensive to produce compared to other types of Vibrators.

Therefore, they can be purchased at a much lower price range compared to other types of Vibrators.

They are especially good for developing clitoral orgasms (outside orgasm) because they provide continuous, strong vibrations to the sexual zones.

I’m not sure if I’m going to be able to do that, but I’m sure I’ll be able to do it.

If you want to know more about outside orgasm, click here to read the article.

The simple design makes it difficult to fine-tune the intensity of the vibrations, but it’s easy to use for outside orgasm users (clitoral orgasms) and sex toy beginners.

By the way, I also started my first sex toy with Egg Vibrators.

| New Skeleton Rotor | Classic Egg vibrators Black *Best Seller* | Skeleton Rotor Twins Red | Dual Pink Vibe | Aqua MANTA 101 | Aqua MANTA 201 | Macaroon Mint |

|  |  |  |  |  |  |

| Rs500 (Best Value) | Rs700 | Rs800 | Rs1125 | Rs2118 | Rs2779 | Rs4147 |

| Dia2.16 × 1.37in | Dai2.1×0.39in | Dia1×2.1~3.9in | Dia0.98×4.3in | Egg-0.8×Manta-4.8 ,Egg-1.9 | Egg-0.8×Manta-4.8,Egg-1.8~1.56.7 | Dia2.1×1.4ind |

| 50g | 38g | ?g | 66g | 118g | 118g | ?g |

| High-quality safe plastic | Plastic | Safe plastic | Safe Plastic | Medical grade rubber | Medical grade Orefin rubber | Medical grade silicone |

| BUY | BUY | BUY | BUY | BUY | BUY | BUY |

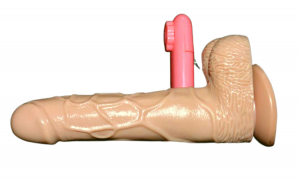

Realistic Dildo Vibrator

Realistic Dildo Vibrators are a type of toy that has a vibration function attached to the dildo introduced earlier.

↑As you can see, the dildo looks like a dildo, but it has a vibrator function. Therefore, you can give vibrations while inserting it.

They are a bit more expensive than other sex toys because they are a bit more complicated to make, but the good thing about dildo-type vibrators is that they can be used in a variety of ways.

They can be used as dildos if they are not turned on, and as Vibrators if they are turned on.

They are also suitable for portio and G-spot development because you can get vibration stimulation while inserting them.

The portio or G-spot is one of the most powerful orgasmic areas in a woman’s sex life, but it is not the first part of the body that can be orgasmic.

However, it is not a part that can be orgasmed from the very beginning, and it requires a certain amount of training to be able to feel orgasm.

One of the most effective ways to train is with dildo Vibrators!

The price is a little higher, but it will definitely give you more satisfaction.

It’s pretty much the manager’s top recommendation among sex toys.

You can buy them in India.

| Finger Dildo | Realistic dildo w vibe-Black | Super Pink Boy *Best Seller* | Realistic dildo w vibe Skin | DESI dildo w vibe | Chuck vibrating dildo 8.5 |

|  |  |  | ||

| Rs1500 (Best Value) | Rs1900 | Rs1900 | Rs1900 | Rs2750 | Rs4500 |

| Dia1.18×8.26in | Dia1.5×9in | Dia1.6×7.87in | Dia?×7.87in | Dia1.5×7.4in | Dia1.5×9.44in |

| 115g | 123g | 145g | 134g | 189g | 317g |

| Silicone | Silicone | Silicone rubber | Silicone | Silicone | Silicone & plastic |

| BUY | BUY | BUY | BUY | BUY | BUY |

Remote Control Vibrators

Remote Control Vibrators are vibrators where the controller and the vibrating part are completely wireless.

↑As you can see, the controller and the vibrator are completely separated, so there is no need to worry about tangled cords when using them.

Depending on the presence or absence of obstacles such as walls or furniture, it can be used within a range of 15 meters in diameter without any particular problems in operation.

Therefore, it is used for shame play outdoors or when you want to masturbate in a more flexible position.

If you’re in a rut with your sex play, or just want something a little more exciting, this is the perfect choice! You can sneak a remote-controlled vibrator under your shorts and have him turn it on when he’s ready, so you can enjoy the thrill of not knowing when you’ll have an orgasm.

The basic design of the Remote Control Vibrators is the same as the Egg Vibrators, but the Remote Control Vibrators are much easier to use and offer a wider range of play options, making them a must-have addition to the standard Egg Vibrators.

PlasticSafe plasticMatt processing materialSafe plastic

| Remote Pleasant egg *Best Seller* | Esper Bonbon Remote Vibrators Pink | Jugar SALTER | LOCO MOTION |

|  |  |  |

| Rs2500 (Best Value) | Rs2632 | Rs2899 | Rs3155 |

| Dai1.1×3.1in | Dia1.18×2.75in | Dia?×2.75in | Dia0.6×2.4in |

| 45g | 118g | 74g | 90g |

| BUY | BUY | BUY | BUY |

Nipple Vibrators

As the name suggests, nipple vibrators are designed to stimulate the nipples.

There are many women who say that their nipples are their sexual zones.

However, it is difficult to stimulate the nipples for a long time…and your hands get tired. This is where Vibrators for nipples come in.

The area around the nipple is small and the skin is thin, making it quite sensitive. The nipple area is small and the skin is thin, so it can easily feel painful when strongly stimulated.

However, many nipple vibrators are made of materials that are designed to give only the vibrations that lead to pleasure without any unnecessary stimulation, so even sensitive nipples can be used without worry.

By the way, if you develop them well, you’ll be able to reach orgasm with just your nipples! To do this, it is important to stimulate your nipples with the optimal strength. Of course, you can also use it on men during sex, so it can be used in a variety of ways.

There are quite a few men who like to have their nipples caressed, so this is highly recommended.

If you want to be able to have an orgasm with just your nipples, or if you want to use Vibrators to accentuate your nipples during sex, nipple-only Vibrators are for you.

| Fing Vibe | CHICHIKURI Paradise | CHICHIKURI MONMON EIGHT | |

|  |  | |

| Rs1625 *Best Value* | Rs2430 | Rs3202 | |

| Dia1 × 3.14in | 35mm One Sucker | 35mm One Sucker | |

| 44g | 181g | 99.8g | |

| Soft Silicone | Soft resin | Soft Rubber | |

| BUY | BUY | BUY |

Strap on

Strap on were originally designed to be inserted into the recipient’s vagina during sex between lesbians. It is also sometimes called a harness dildo or penis band.

↑As you can see, the dildo can be fixed to the belt that is worn around the waist, and it feels like a real penis. Many of the belts are made of leather and look very stimulating.

Some Strap on allow the dildo to be inserted into both the recipient’s and the aggressor’s vagina. (This is slightly different from the double-headed dildos.)

There are many different types of dildos used in Strap on, but most seem to be non-realistic dildos.

There are many different types of dildos used in Strap On, but most of them seem to be non-realistic dildos.

Many lesbian women have always been uncomfortable with men’s penises, so this is probably a remnant of trying to get rid of that. However, it can also be used by straight couples to allow the woman to insert it into the man’s anus.

This is a bit of a deviation from the introduction as a toy for women, but it is also recommended for men who have trouble getting a long-lasting erection, lack confidence in their penis, or tend to lose it inside. If you are a man, it is best to choose a hollow type dildo.

If you’re a straight couple using it to accentuate your sex life, or if you’re a lesbian using it to penetrate each other, you should choose the Strap On.

Unlike a dildo alone, you can insert it hands-free, so you can check your partner’s every move and caress her as you insert it. It’s a great way to enjoy affectionate play.

| Lesbian Strap on vibrator dildo | 5in Desi Strapon dildo | New JOY BELT Black *Best Seller* | EROTIC PARTNER Msize | Pegging Fetish 2 |

|  |  |  | |

| Rs3482 (Best Value) | Rs3875 | Rs3999 | Rs4199 | Rs4995 |

| Dia1.8×7in | Dia1.3×5.5in | Dia1.37×6.10in | Dia1.5×5.3in | Dia1.3×5.5in |

| waterproof:No | waterproof:Yes | waterproof:No | waterproof:Yes | life waterproof specification |

| Rubber | Silicone (dildo part) | Soft Rubber | Belt – cloth Dildo – soft material | Medical grade silicone |

| BUY | BUY | BUY | BUY | BUY |

[BEST5]2021 Best Selling Sex Toys for Women in India

If you’re looking for the best sex toys for women in India, here’s a list of the best-selling sex toys for women in India 2021. It’s only the beginning of 2021, but if you’re considering introducing sex toys this year, we’ve picked out five sex toys that you should definitely try from our point of view.

If you’ve never had an orgasm from masturbation, or if you’ve had orgasms from masturbation but not from sex… If you’re having problems with orgasms, try these five sex toys.

XXX Indian Dick Man 6

XXX Indian Dick Man 6 is a dildo for women in India that faithfully reproduces the penis of an Indian man.

The XXX Indian Dick Man 6 is a must have for any woman living in India or wIndian paith an rtner when considering purchasing a dildo!

It is made of a very good quality silicone material and focuses on a more realistic penis feel.

It doesn’t have a suction cup at the base, but it is cut to be stable when placed, so it is recommended for women who like to ride.

The unit itself weighs 175g, just about the same as my current smartphone, so it is not a burden when I want to hold it in my hand and piston it.

If you take good care of it, you can use it for years to come.

BUY XXX Indian Dick Man 6 in India

Super Pink Boy

The Super Pink Boy, with its clear pink appearance, is classified as a Dildo-type Vibrator.

With its simple operation, it is easy to use even for those who are not good with machines.

It is powered by batteries, so there is no need to recharge it.

The price is Rs1900, which is one of the lowest among the Dildo Vibrators, and it is very popular among Indian women.

I also own this toy but it is especially suited for beginners. This toy can be used as both Dildo and Vibrator, so it is a great bang for the buck.

It can be used as a Dildo when not powered on, or as a Vibrator when powered on.

If you want to develop Portio, Clitoris, or G-spot, this is the product that can meet all of your needs in a balanced way.

In India, there are many women who live with their families, and even if they live with their families, they can use the toy without making any noise as long as they do not turn on the vibrator function, which is a point that is popular among Indian women.

My caiman

My caiman is a great product for women who want a stimulating sex toy.

With a length of 9 inches, it is sure to satisfy any woman, no matter how inadequate she thinks she is.

The reason why I recommend My caiman is because of its overwhelming realism. It feels just like a real penis and has excellent flexibility and elasticity. It feels more realistic than any Dildo I’ve ever used.

It has a strong suction cup at the base, so you can glue it to the wall, floor, chair, or any other place in the bathroom to enjoy any position you want.

It has a strong visual impact, which will surely make you more excited.

However, this toy is very stimulating, so it is not recommended for virgins.

It is recommended for women who have had sex to some extent and are looking for a more stimulating toy.

The reason why My Caiman is selling so well among Indian women is because of its realistic texture. The real feel of the toy, which no other dildo can offer, is what attracts Indian women.

Classic Egg Vibrators Black

Classic Egg Vibrators Black is an basic egg vibrator.

The price is Rs700, which is by far the cheapest and easiest to acquire!

Don’t underestimate it just because it’s cheap. The vibration strength is comparable to toys priced above Rs2000, or more.

It can be used to stimulate the nipples and clitoris, and can even be inserted into the vagina with a condom over it.

The controller and vibrating part are connected by a cord, so you don’t have to worry about it getting into your vagina.

If you’ve never had an external orgasm, if you’re interested in sex toys but don’t want to pay the price, or if you don’t know where to start with the many different types of vibrators available, the Classic Egg vibrators Black are a great choice.

If you’re not sure where to start with the various types of vibrators, the Classic Egg Vibrators Black is a good choice.

Many women may feel uncomfortable buying an expensive sex toy when they still have a lot to learn about sex toys. In such cases, the Classic Egg vibrators Black, which can be purchased for around Rs700, may be a safe bet.

BUY Classic Egg Vibrators Black in India

Realistic dildo w vibe-Black

Realistic dildo w vibe-Black is a straight Dildo type Vibrator.

The difference between the Realistic dildo vibe-Black and the Super Pinkboy, which is also a straight dildo vibrator, is the coloring and material.

While the Super Pinkboy uses a single material for the dildo part, the Realistic dildo w vibe-Black uses two layers for the dildo part.

The dildo part of the Realistic dildo w vibe-Black is made in two layers, so the texture is the same as when you actually touch a real penis.

Also, the insertion part is about 5cm longer than Super Pinkboy, so if you want a more stimulating dildo of the same type, I recommend this Realistic dildo w vibe-Black.

The Realistic dildo w vibe-Black can also be used as a dildo with the power turned off, just like the Super Pinkboy.

BUY Realistic dildo w vibe-Black in India

How to make sex toy for women?

By the way, if you’ve read this far and you’re thinking

Sex toys are attractive, but the price is a bit high for me.

I’m a little reluctant to order a sex toy to buy.

I don’t want to leave my sex toy at home (I don’t want my family to find it).

There are probably some people who do. In that case, you can easily make your own dildos with things you are familiar with.

For more information on how to make a dildo using everyday items, please check out the following article.

I’ve tried making my own dildos, and while the process of making them is fun, the feel can be a bit delicate. It’s a good idea to buy a cheap dildo if that’s what you’re looking for. However, there are some things that you can’t understand until you try them out, so I think it’s okay to try DIY.

How women in India choose sex toys

When choosing a sex toy, it is important to keep the following points in mind.

- Buy a small one first.

- Choose a soft material at first.

- Choose with the purpose of use in mind.

When choosing a sex toy, especially if you are a beginner, it is recommended to start with a small one.

Some sex toys are very stimulating and come in larger sizes, but the larger ones can be too stimulating or difficult to insert into an undeveloped vagina.

If you force yourself to insert it or use a one with strong stimulation, it may damage the skin that is not accustomed to the stimulation or cause a wound in the vagina. If the delicate zone is scratched, bacteria can enter and cause inflammation.

It is also a good idea to choose sex toys that are made of soft materials such as silicone or elastomer at first. This is especially true for insertable toys.

The vagina and skin of a sex toy beginner are not used to the insertion and stimulation of a toy.

Therefore, if you use a hard sex toy before you are used to it, it can cause scarring as well.

Finally, it is also important to choose a sex toy with the purpose of use in mind.

Do you want to use it for sex? Do you use it for masturbation? Do you like the sensation of internal orgasm? Or external orgasm? If you’re looking for a sex toy, you’re going to have to choose one that’s right for you.

How Indian women use sex toys in the most comfortable way

Next, let’s check out how Indian women use sex toys most comfortably.

If you thought that women only use sex toys when they masturbate, it is true that the main use of sex toys is masturbation. But in fact, it is possible to enjoy quite stimulating sex by incorporating sex toys not only in masturbation but also in sex.

We’ve been dating for quite a while now, but thanks to sex toys, we’ve never felt stuck in a sex rut.

In this article, I will explain two ways to use sex toys: one is to use them for masturbation, and the other is to use them for sex.

So let’s check them out right away!

Using a sex toy in masturbation

The first method is to use a sex toy in masturbation.

If a woman is going to use a sex toy in masturbation, it is recommended that she use it to develop her sex points.

The G-spot and portio are famous sexual zones for women, but they are places where you cannot have an orgasm unless you develop them.

But once you can develop it, then you can already feel deep pleasure! It’s also a great way to train yourself to have an orgasm during sex.

If you want to know more about women’s sexual zones, click here.

As I mentioned a little bit earlier, this female sex zone development is difficult to develop, and trying to do it with just your fingers during sex or masturbation is very difficult.

If you try too hard to develop the G-spot, you may end up with tendonitis in your fingers… or worse! However, if you use a sex toy, you can avoid such a situation.

For more information on how to use sex toys to develop your G-spot, please check out the following article.

Using a sex toy in sex

Next, how to use sex toys in sex.

When using sex toys in sex, dildos, Vibrators, Strap ons, and lotions are recommended.

If you use dildos in sex, you can use them as a bridge when your male partner is tired of insertion, or you can insert the dildo into yourself while blowjobbing your male partner. It should be visually quite stimulating.

Vibrators are recommended for stimulating not only women’s sex zones, but also men’s nipples, glans, and other sex zones. Many of them are not used to being touched as much as women are, so they may become addicted to the new pleasure.

Strap on is recommended when a man wants to have sex but can’t get his penis erect as he wants, or when a woman wants to blame him.

It is also good to use plenty of SexLubricant and play with each other’s skin to make you feel at ease.

As you can see, there are many ways to use sex toys in addition to using them alone, so if you’re a couple who loves new things, or if you want to give your partner a deeper sense of pleasure, I highly recommend you incorporate sex toys into your life!

If you want to know more about sex toys for couples, this article is also helpful.

How to buy a sex toy in India

Finally, let me also explain how to buy a sex toy in India.

To put it bluntly, if you want to buy sex toys in India, sex toy online stores are the way to go!

There are three ways to buy sex toys in India: at a store, at a sex toy online store, or at an e-commerce site like Amazon or Snapdeal.

Of these, the one that I recommend for Indian women to buy is from sex toy’s online store.

Most of the sex toy online stores will deliver the products to you in a privacy-friendly way so that you can’t see what’s inside, and you don’t have to worry about the security aspect of the payment.

If you live with your family and don’t want them to find out about your sex toy purchase, this is a good option.

If you want to find out more about how to buy sex toys, please check out this article.

The best way to buy a sex toy is through an online store, but it is important to be aware that there are some sites that have not been in operation for a long time and are not very reliable. In this regard, SexToysINDIA is a trustworthy company that operates out of Delhi, so you can buy with confidence.

Is it embarrassing to buy a sex toy?

I’m very interested in sex toys, but I’m still embarrassed to buy them. I feel like it’s kind of immodest for a woman to buy such a toy.

I can understand how you feel! Especially in India, there are a lot of sexual restrictions, so I feel that it’s not so good for women to be sexually active. However, it is a normal physiological phenomenon that women have sexual desires just like men do. There’s nothing wrong with that.

When purchasing a sex toy, especially if it is your first time, you may have some of the above concerns.

However, according to a recent survey, roughly 40% of sex toy buyers are women.

There’s nothing wrong with relieving your sexual desire in a proper way.

There’s no need to be embarrassed about it, it’s just that we don’t talk about sex toys with our friends. You don’t have to be embarrassed about it because you just don’t talk about sex toys with your friends, and the girl next door might be masturbating with a sex toy.

Compilation of sex toys available in India

What do you think? In this article, I have explained about sex toys for women that can be purchased in India.

Women’s sex toys can be used for masturbation and sex to give you orgasms that humans can never match, or to add a new accent to your regular sex life.

In India, there is still a lot of resistance to the purchase of sex toys by women due to public perceptions and their own values.

However, women’s pursuit of orgasm has many benefits.

In particular, orgasms are very helpful for physical and mental health. The following article describes the benefits of orgasms for women, so please check it out as well.